All Categories

Featured

Table of Contents

- – How do I optimize my cash flow with Infinite B...

- – Is Infinite Banking In Life Insurance a good s...

- – What happens if I stop using Infinite Banking...

- – What are the tax advantages of Cash Value Lev...

- – How do I track my growth with Financial Leve...

- – How do interest rates affect Whole Life For ...

- – Generational Wealth With Infinite Banking

Term life is the best option to a momentary demand for safeguarding against the loss of a breadwinner. There are much less factors for permanent life insurance coverage. Key-man insurance and as part of a buy-sell contract entered your mind as a possible great reason to buy a permanent life insurance policy plan.

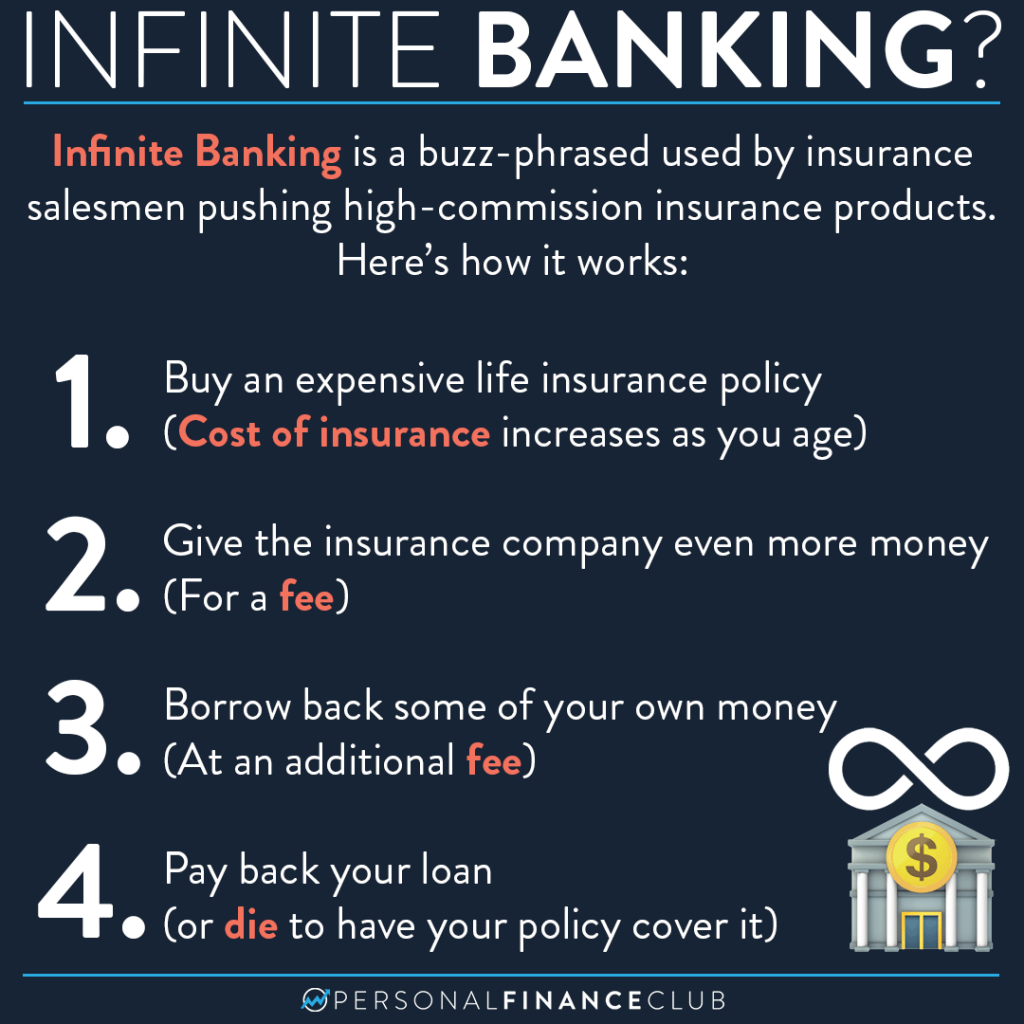

It is a fancy term coined to sell high priced life insurance policy with enough compensations to the representative and enormous profits to the insurance provider. Policy loan strategy. You can reach the exact same outcome as infinite financial with far better outcomes, even more liquidity, no risk of a plan gap triggering a massive tax obligation problem and more alternatives if you use my alternatives

How do I optimize my cash flow with Infinite Banking Vs Traditional Banking?

My prejudice is good details so come back here and find out more posts. Contrast that to the biases the promoters of infinity financial receive. Here is the video clip from the promoter made use of in this article. 5 Mistakes People Make With Infinite Banking.

As you approach your gold years, monetary safety is a top concern. Amongst the numerous different financial techniques out there, you may be listening to increasingly more regarding boundless banking. Policy loans. This idea enables almost anyone to become their very own lenders, offering some advantages and flexibility that could fit well right into your retired life plan

Is Infinite Banking In Life Insurance a good strategy for generational wealth?

The loan will build up straightforward rate of interest, but you maintain flexibility in establishing repayment terms. The rate of interest is likewise generally reduced than what you would certainly pay a traditional bank. This type of withdrawal enables you to access a portion of your cash money value (as much as the amount you have actually paid in costs) tax-free.

Numerous pre-retirees have issues regarding the security of infinite financial, and for good factor. The returns on the cash worth of the insurance policy plans might fluctuate depending on what the market is doing.

What happens if I stop using Infinite Banking Benefits?

Infinite Banking is a financial method that has actually obtained substantial interest over the past few years. It's an unique technique to managing individual financial resources, enabling people to take control of their money and produce a self-reliant financial system - Self-banking system. Infinite Banking, likewise referred to as the Infinite Banking Principle (IBC) or the Rely on Yourself method, is a monetary method that involves utilizing dividend-paying entire life insurance policy plans to create an individual financial system

Life insurance policy is a crucial component of economic planning that provides numerous benefits. Whole life for Infinite Banking. It comes in numerous shapes and sizes, the most usual kinds being term life, entire life, and universal life insurance policy.

What are the tax advantages of Cash Value Leveraging?

Let's discover what each type is and just how they vary. Term life insurance policy, as its name recommends, covers a particular duration or term, usually in between 10 to 30 years. It is the most basic and frequently the most affordable sort of life insurance. If the policyholder dies within the term, the insurance firm will pay out the survivor benefit to the assigned recipients.

Some term life policies can be restored or exchanged an irreversible plan at the end of the term, but the costs generally enhance upon renewal because of age. Entire life insurance is a sort of permanent life insurance policy that offers coverage for the insurance holder's whole life. Unlike term life insurance coverage, it includes a cash worth component that grows with time on a tax-deferred basis.

It's important to bear in mind that any type of superior fundings taken versus the policy will certainly lower the death advantage. Whole life insurance policy is generally much more costly than term insurance policy because it lasts a life time and develops money value. It additionally supplies foreseeable premiums, indicating the cost will not raise gradually, offering a level of certainty for insurance holders.

How do I track my growth with Financial Leverage With Infinite Banking?

Some factors for the misconceptions are: Complexity: Entire life insurance policies have more elaborate attributes compared to describe life insurance, such as cash value accumulation, dividends, and plan lendings. These functions can be challenging to understand for those without a background in insurance policy or individual finance, resulting in confusion and misunderstandings.

Prejudice and misinformation: Some individuals may have had negative experiences with entire life insurance or heard tales from others who have. These experiences and anecdotal details can add to a biased view of whole life insurance policy and perpetuate misunderstandings. The Infinite Financial Idea approach can just be carried out and performed with a dividend-paying entire life insurance policy with a shared insurer.

Through strategic cash value leveraging, families can fund major life expenses.

Parents can use Infinite Banking to create a financial safety net, all while retaining ownership of their capital.

Legacy planning experts assist in structuring Infinite Banking policies - how to start infinite banking. Discover how Infinite Banking can build your family’s legacy to secure your family’s future for generations

Whole life insurance is a sort of permanent life insurance that offers insurance coverage for the insured's entire life as long as the premiums are paid. Entire life plans have 2 major elements: a survivor benefit and a money value (Self-banking system). The survivor benefit is the quantity paid out to recipients upon the insured's fatality, while the cash value is a cost savings element that expands with time

How do interest rates affect Whole Life For Infinite Banking?

Reward settlements: Mutual insurance policy business are owned by their insurance holders, and therefore, they may disperse profits to insurance holders in the kind of rewards. While dividends are not ensured, they can help boost the cash money value development of your policy, increasing the total return on your funding. Tax advantages: The cash money value growth within a whole life insurance policy policy is tax-deferred, implying you do not pay tax obligations on the growth up until you take out the funds.

Liquidity: The cash money value of an entire life insurance plan is extremely fluid, enabling you to accessibility funds conveniently when required. Property protection: In lots of states, the cash worth of a life insurance coverage policy is shielded from creditors and suits.

Generational Wealth With Infinite Banking

The plan will have instant money worth that can be positioned as collateral thirty days after funding the life insurance policy policy for a revolving line of credit scores. You will have the ability to accessibility via the rotating line of credit approximately 95% of the readily available money value and use the liquidity to money an investment that supplies earnings (capital), tax obligation benefits, the possibility for admiration and leverage of other individuals's ability collections, capabilities, networks, and resources.

Infinite Financial has become extremely prominent in the insurance policy globe - also much more so over the last 5 years. Numerous insurance agents, throughout social media sites, case to do IBC. Did you understand there is an? R. Nelson Nash was the creator of Infinite Financial and the organization he founded, The Nelson Nash Institute, is the only company that formally authorizes insurance agents as "," based upon the adhering to criteria: They straighten with the NNI standards of professionalism and reliability and principles.

They successfully finish an instruction with a senior Licensed IBC Expert to guarantee their understanding and capability to use every one of the above. StackedLife is Licensed IBC in the San Francisco Bay Area and works nation-wide, aiding clients understand and carry out The IBC.

Table of Contents

- – How do I optimize my cash flow with Infinite B...

- – Is Infinite Banking In Life Insurance a good s...

- – What happens if I stop using Infinite Banking...

- – What are the tax advantages of Cash Value Lev...

- – How do I track my growth with Financial Leve...

- – How do interest rates affect Whole Life For ...

- – Generational Wealth With Infinite Banking

Latest Posts

How Do I Start My Own Bank?

How To Use Whole Life Insurance As A Bank

Be Your Own Banker Whole Life Insurance

More

Latest Posts

How Do I Start My Own Bank?

How To Use Whole Life Insurance As A Bank

Be Your Own Banker Whole Life Insurance